Even though Bitcoin currently trades below its record-breaking peak, this cryptocurrency shows tenacity that can’t be overlooked. Its resilience is not baseless. Several factors, including technical indicators, on-chain data analysis, and future events such as the expected 2024 halving event and potential SEC approval of a Bitcoin ETF, all signal that Bitcoin (BTC) is far from meeting its demise.

Just a couple of years back, Bitcoin (BTC) was enjoying a staggering value of over $65,000. It even went up and struck its all-time high (ATH) of nearly $70,000 in November 2021. However, the relentless grip of the so-called ‘crypto winter,’ which began in late 2021 and stretched into 2022, wreaked havoc on its value, causing a sharp decline of around 80%. By the dawn of 2023, this crypto titan, which led the market cap rankings, was being traded for less than $17,000.

For an extended period, cryptocurrency traders found themselves in a seemingly never-ending tunnel, with no light twinkling at the end. This dire situation ignited the question – is Bitcoin dead?

For years, the heated debate on Bitcoin’s survival persists, particularly during every bearish market. However, it’s important to note that the question of Bitcoin’s demise becomes pertinent only if BTC were to collapse entirely, perhaps due to a powerful 51% attack when quantum computers reach unimaginable capacities. Until such an event, Bitcoin remains very much alive and kicking.

On-Chain Data and Technical Indicators

On-chain data refers to information recorded directly on the blockchain. This includes transaction volume, active addresses, and more that contribute to an understanding of Bitcoin’s economic health. Similarly, the technical indicators are statistical tools used by traders to anticipate future price trends. The resilience shown by Bitcoin despite the ‘crypto winter’ tends to rely on these metrics and their positive outlook.

Anticipated Events

The halving event scheduled for 2024, where the miners’ reward would be slashed by half, is a significant future event. Historical data shows that Bitcoin’s price experienced a significant surge during past halving events. Similarly, the potential approval of a Bitcoin ETF by the SEC could open new avenues of investments, thus improving Bitcoin’s standing in the financial market.

The 51% Attack

Simply put, a 51% attack refers to a situation where a single entity or group controls the majority (51% or more) of the network’s mining hash rate. This gives them the power to disrupt the entire network, even potentially double-spending coins.

The Endless Bitcoin Obituaries

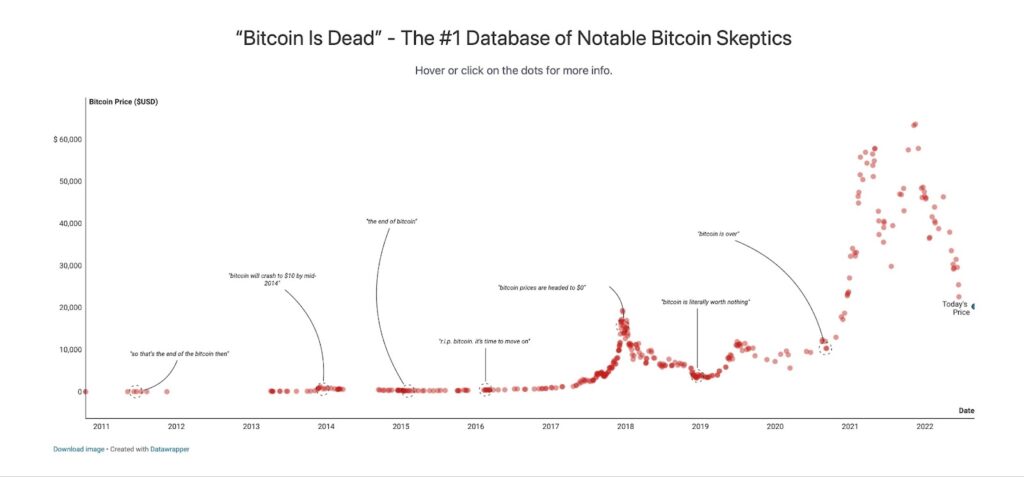

Bitcoin has defied the odds and proved critics wrong time and again since its inception. The digital icon has been pronounced ‘extinct’ in over 400 instances, with major media entities such as CNBC and Bloomberg delivering many of these obituaries.

Below are some of the sensational headlines that predicted Bitcoin’s doom:

- “Bitcoin’s Doomsday: The Final Tumble to Null” (2014);

- “Kiss Bitcoin Goodbye. It’s Time for a New Chapter” (2016);

- “Bitcoin, the Largest Bubble in History, Is Bursting” (2018);

- “Bitcoin and Ethereum Primed for Descent to Nothingness” (2022).

Despite the perpetual question of Bitcoin’s survival, the cryptocurrency has managed to rise from the ashes each time. It’s important to delve into why these obituaries have been proven wrong and understand the primary factors that uphold Bitcoin’s endurance.

Recounting Bitcoin’s Journey in 2023

Bitcoin, the most popular digital currency, has experienced a notable upswing by the end of October 2023. Current statistics show that Bitcoin’s price is hovering just over the $33,500 mark. This upward trend gives a sense of optimism to investors, especially considering the coin’s journey of resilience and growth throughout the year.

The significant rally starting in mid-October has pushed Bitcoin to a 16-month high, reaching $35,000 in the last week of October. Let’s put that into perspective: Bitcoin was valued under $25,000 as recently as mid-September. The rapid rise in value underlines Bitcoin’s capacity to bounce back even when the odds seem stacked against it.

With the latest rally, Bitcoin is not only consolidating above the crucial $30,000 mark, but it may also be putting the final touch to the prolonged negative market sentiment. The steady rise in value seems to be a been a beacon of hope for those who might have thought that Bitcoin was approaching its end.

In a remarkable show of strength, Bitcoin has doubled its market value within this year alone. This is impressive compared to the returns of the S&P 500, thrusting Bitcoin into the spotlight as a preferable investment option for many. While the groundwork is set for possible further ascent in the year to come, it’s also crucial to ponder the potential for a discernible correction.

Technological advancements, like the implementation of Ordinals, and the launch of Bitcoin’s layer 2 protocols have contributed significantly to bolstering Bitcoin’s dominance in 2023. These developments are growing the functionality of the Bitcoin network and allowing for improved scalability, thereby adding to the value proposition of Bitcoin.

Current Bitcoin Landscape: A Comprehensive Breakdown

Let’s dive into Bitcoin’s current scenario from every possible angle.

Delving into Technical Analysis

Bitcoin kicked off the year trading under $17,000, a benchmark it has yet to surpass again. Nonetheless, this year saw the genesis of multiple ‘flag patterns,’ characterized by a substantial upsurge (the flagpole) followed by a confluence phase.

Let’s shed light on the specifics:

- Larger timeframes exhibit bullish flag wedges;

- If this trend holds, the recent upsurge could well be the flagpole of another pattern, hinting at a potential year-to-date high in the near future;

- A noteworthy bullish indicator is the impending ‘golden cross.’ This occurs when the 50-day moving average (MA) surpasses the 200-day MA from beneath. The last such event was recorded in February.

Based on these indicators, Bitcoin’s overall health seems to be on the mend rather than on the brink of extinction.

September turned out to be a pivotal month for Bitcoin, characterized by the formation of two flags that could represent a double peak—a potent bearish pattern. Had the price dipped below the pattern’s neckline, it might have slumped under $20,000.

An Overview of Fundamental Analysis

Switching gears, let’s inspect Bitcoin’s fundamental metrics. Bitcoin’s role as a store of value (SOV) was further cemented in 2021, especially amidst the backdrop of rampant inflation in developed economies like the US and the European Union (EU). Numerous high-profile investors opted for cryptocurrencies as a safeguard against the depreciating value of fiat money.

Despite losing steam in 2022 due to a string of unsuccessful crypto ventures (FTX included) and central banks elevating interest rates to rein in inflation, Bitcoin retains its strength amidst global instability caused by substantial geopolitical discord and conflicts.

Given Bitcoin’s deflationary model that caps its supply at 21 million and diminishes the rate of issuance courtesy of the programmed ‘halving,’ it maintains its sturdy position despite market fluctuations.

Tracing Bitcoin’s Path through On-Chain Data

On-chain data serves as a pertinent lens to gauge the ongoing dynamics of Bitcoin by observing the behavior of its participants on the Bitcoin network. Such data is indispensable to examining Bitcoin’s adoption trends among retail and institutional investors, even amid various challenges.

These challenges encompass:

- Market Volatility: The unpredictable swings in the value of Bitcoin;

- Scalability limitations: Bitcoin’s transaction processing capacity is significantly lesser than traditional digital payment networks;

- Narrow Use Cases: Bitcoin is predominantly perceived as a store of value or ‘digital gold,’ and its acceptance as a medium of exchange remains limited;

- Regulatory Ambiguity: The regulatory environment for cryptocurrency varies significantly across different jurisdictions and remains a point of contention;

- Cybersecurity Risks: The threat of hacks and security breaches on both centralized and decentralized cryptocurrency exchanges;

- Complexity: The technical intricacies of cryptocurrency can be daunting for the average users.

Despite these hurdles, specific on-chain metrics show that Bitcoin’s adoption is on the upswing. Glassnode’s data reveals that the count of Bitcoin wallet addresses holding positive balances is nearing the 50 million mark. The year 2023 has witnessed a surge in the creation of new addresses.

Moreover, the tally of active Bitcoin addresses per day has found a stable base around the 1 million mark, a figure that doesn’t fall far from the peaks seen in 2017 and 2021.

Deciphering the Challenges To Bitcoin’s Ascent

Despite the promising signs pointing towards a sustained Bitcoin rally, it’s imperative to be cognizant of potential hurdles that could hinder Bitcoin’s progress and growth.

A major stumbling block arises from the regulatory landscape that governs cryptocurrencies. It’s not homogeneous across the globe, and this disparity can often breed uncertainty.

In the United States, one of the most influential markets for cryptocurrencies, regulatory ambiguity looms large. This sentiment was captured by Chamath Palihapitiya, a well-known Bitcoin supporter, who went on record to proclaim that the future of crypto in America seems bleak.

Such a standpoint is shared by prominent crypto platforms such as Coinbase and Gemini, which are contemplating shifting their operations away from the US market due to this regulatory uncertainty.

Another factor that adds to the uncertainty is the US SEC’s (Securities and Exchange Commission) hesitance in approving the Bitcoin ETF (Exchange-Traded Fund). A series of delays in this approval process into 2024 could potentially trigger a resurgence of pessimism among Bitcoin traders, potentially slowing down or even halting the Bitcoin rally.

Aave vs. Compound: DeFi Titans

In the realm of decentralized finance (DeFi), Aave and Compound are leaders reshaping the crypto landscape. As we explore Bitcoin’s future, it’s crucial to recognize the impact of these platforms.

Aave, founded in 2017, offers user-friendly lending and borrowing services with its native token, AAVE, empowering governance.

Compound, launched in 2018, pioneered algorithmic interest rates with COMP tokens enabling community-driven changes.

Both platforms focus on transparency, security, and user empowerment. Aave excels in flash loans, while Compound optimizes asset allocation.

This competition drives DeFi innovation, aligning with Bitcoin’s resilience and shaping the crypto future.

Conclusion

In conclusion, the fate of Bitcoin remains a topic of constant debate and scrutiny. Despite enduring numerous setbacks and market fluctuations, Bitcoin has displayed remarkable resilience and an ability to bounce back from adversity time and again. Its future is influenced by a complex interplay of factors, from on-chain data and technical indicators to upcoming events and regulatory developments. While challenges and uncertainties persist, Bitcoin’s enduring value proposition, deflationary model, and growing adoption suggest that it is far from being on the brink of extinction. As we navigate the evolving landscape of cryptocurrencies, Bitcoin continues to assert its presence as a potent force in the world of finance, leaving us to wonder not if it will survive, but how high it will rise in the years to come.