Bitcoin’s adoption cycle has been nothing short of astonishing. This revolutionary, digital form of currency has had an impressive trajectory since its inception over a decade ago. It has rapidly grown from an obscure concept to its current position as an alternative, legitimate financial instrument attracting millions of investors worldwide.

Bitcoin Acceptance: A Comprehensive Overview

The cryptocurrency market, spearheaded by Bitcoin, is characterized by diverse adopters. These enthusiasts are spread across different segments of the population, including:

- Pioneers and Crypto Advocates: These enthusiasts were among the first to embrace Bitcoin. They recognized its potential as a decentralized currency and laid the groundwork for its initial adoption;

- Tech-Savvy Investors: This group comprises individuals with an inherent understanding of decentralized technology. They acknowledge Bitcoin’s potential to disrupt traditional economic systems and provide a viable alternative to conventional currencies;

- Retail Investors: These are everyday individuals who have been lured by the potential returns offered by Bitcoin. Despite having limited technical understanding, these investors have taken to Bitcoin as a speculative asset or a hedge against financial uncertainty;

- Institutional Investors: This group encompasses large-scale organizations like corporations, endowments, or pension funds. They’ve entered the Bitcoin space due to potential profits and the opportunity to diversify their portfolios.

To gauge Bitcoin’s acceptance, we can look at the trajectory of active Bitcoin addresses. This metric has seen a steady rise, peaking in 2021, and currently averaging around one million active addresses.

While these active addresses form a mere fraction of the total, they wield substantial influence on Bitcoin adoption. According to BitInfoCharts, the number of Bitcoin wallets holding over $1 has risen to over 41 million, a noticeable surge from 35 million in the previous year.

Furthermore, data from Glassnode reveals that almost 50 million BTC addresses hold non-zero balances. Significantly, the most bustling periods for new address creation were the years 2017, 2021, and 2023.

The Pivotal Year for Bitcoin Exchange Activity: An Insight into 2021

Understanding the level of acceptance for the pioneer cryptocurrency – Bitcoin, could be effectively achieved by observing the volume of Bitcoin inflows and outflows transacted in cryptocurrency exchanges.

Formidably contributing to the popularity of cryptocurrency, platforms such as Coinbase and Binance have revolutionized the digital currency space. These platforms have become instrumental in facilitating interaction between conventional finance and the burgeoning world of cryptocurrency. Offering an avenue for retail users’ active engagement, these exchanges have served as a crucial bridge linking the traditional and crypto universes.

Similar to the pattern seen with active Bitcoin addresses, trading activity within these cryptocurrency exchanges recorded a peak in 2021. However, since this zenith, an adjustment in activity levels has been noted, experiencing a downward shift.

The Influence of Crypto Exchanges

As the pillars of the cryptocurrency ecosystem, platforms like Coinbase and Binance play a vital role. Their influence extends beyond merely facilitating trades. Allow us to delve into some of the ways these exchanges have contributed to global Bitcoin adoption:

- Democratizing Financial Systems: Crypto exchanges have made digital investment accessible to every individual with an internet connection. This democratization of finance has opened the doors for a new cohort of retail investors to partake in the thriving crypto market;

- Fueling Crypto Education: Crypto exchanges often double as learning resources. They provide educational content about cryptocurrencies, market trends, and trading strategies. Through this, they are raising a generation of informed cryptocurrency enthusiasts;

- Custodial Services: These platforms offer secure storage options for digital assets. With this, they have instilled confidence and trust in individuals who might otherwise be wary of digital asset security;

- Global Accessibility: Crypto exchanges have erased geographic barriers, allowing anyone from any part of the world to participate in the Bitcoin market.

Analyzing Regional Patterns in Bitcoin Uptake

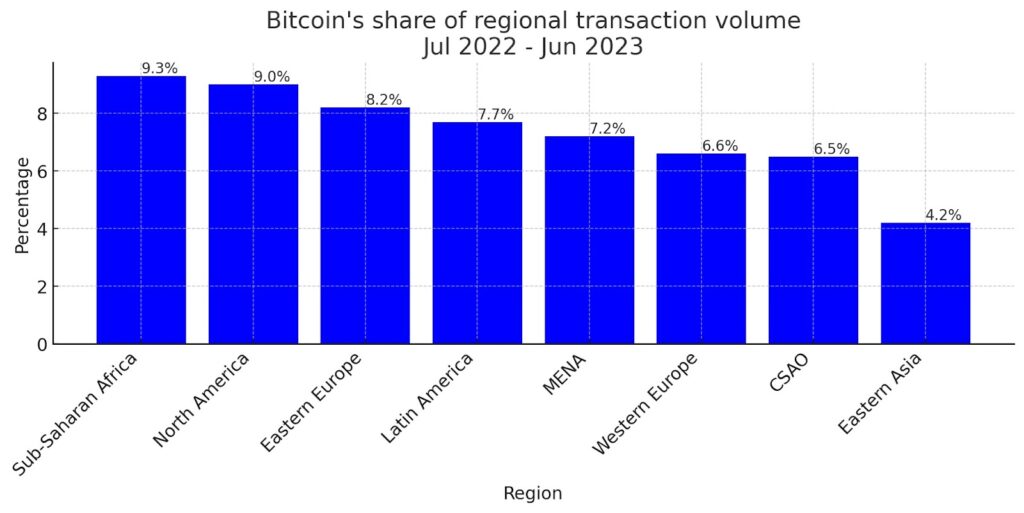

Undeniably, Bitcoin’s adoption has shown a growing trend worldwide. Still, a recent report titled “The Global Landscape of Cryptocurrency” by Chainalysis illuminates some interesting regional preferences.

Surprisingly, Sub-Saharan Africa towers in terms of Bitcoin activity, hosting 9.3% of total transactions, closely trailed by North America which accommodates approximately 9.0% of overall Bitcoin activity.

In regions grappling with high levels of inflation and debts such as Africa, Bitcoin, often seen as a sanctuary of value, offers an appealing financial alternative. Its acceptance signifies a hopeful trend in nations where economic instability places an immense strain on the population.

Interestingly, despite Bitcoin’s surging popularity, stablecoins including Tether (USDT), USD Coin (USDC), and DAI persistently overshadow Bitcoin in terms of transaction volume across all regions.

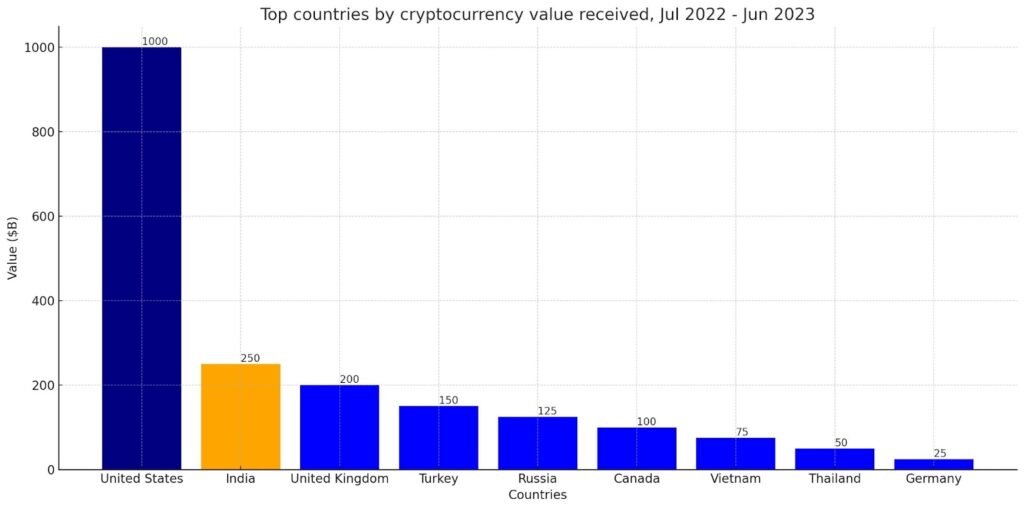

Diving deeper into the realm of overall crypto adoption, a list of frontrunners emerges:

- India: India leads the pack in overall cryptocurrency adoption. Despite an initially rocky relationship with digital currencies, the nation has witnessed a significant surge in crypto acceptance in recent years;

- Nigeria: Given its pioneering position in Bitcoin adoption, it’s no surprise that Nigeria ranks highly in overall adoption as well. With a youthful, tech-savvy population and an economy plagued by inflation, cryptocurrencies offer a viable alternative to traditional finances;

- Vietnam: Vietnam’s burgeoning tech industry and its government’s positive stance towards cryptocurrencies have driven its high crypto adoption rates;

- United States: The U.S. maintains a prominent position in the global crypto scene. As of June 2023, it held the record for the highest volume of received cryptocurrency over a span of twelve months;

- Ukraine: Ukraine rounds out the top five, demonstrating a healthy appetite for cryptocurrencies, particularly among its tech-forward youth.

Unraveling the Elements Propelling Bitcoin Acceptance

It’s fascinating to explore the factors that have accelerated the worldwide adoption of Bitcoin. Let’s delve deeper into some of the crucial elements catalyzing this transformational shift:

- A Refuge Against Inflation: The inherent structure of Bitcoin, often likened to digital gold, serves as a buffer against inflation. This comes into play due to its limited supply, capping at 21 million. Added to this, the process of Bitcoin halving systematically reduces the rate of new Bitcoin entering the market, thereby curbing inflation. This characteristic has drawn substantial interest from investors looking to shield their wealth from the escalating global inflation rates;

- The Rise of Institutional Interest: The perception of Bitcoin has evolved from that of a shadowy virtual currency to a credible investment opportunity, thanks to the burgeoning interest from institutional investors. Titans like Grayscale, Tesla, Microstrategy, and The Block are among those who have significantly invested in Bitcoin;

- Integration with Web3 and DeFi Applications: While Bitcoin’s blockchain is often perceived as rigid, the advent of Layer 2 solutions such as the Lightning Network and Stacks has transformed this. These solutions have enabled the integration of Bitcoin with decentralized applications and financial tools. This has expanded Bitcoin’s use-cases beyond a mere digital currency to a versatile asset within the expansive DeFi landscape;

- Anticipation of Bitcoin ETFs: There is a mounting anticipation within the crypto community for the approval of a Bitcoin ‘spot’ exchange-traded fund by the U.S. Securities and Exchange Commission (SEC). Several financial heavyweights, including Blackrock, Fidelity, VanEck, ARK Invest, and Galaxy Digital, have pending applications for their proposed ETFs with the regulatory body. The approval of these funds could trigger an influx of institutional capital into Bitcoin, potentially catapulting its value.

Challenges Holding Back the Mass Adoption of Bitcoin

While Bitcoin’s potential for disrupting the global financial landscape is evident, its pathway to vast acceptance isn’t devoid of hurdles. Here, we outline key barriers to Bitcoin’s mass adoption:

- Volatility: Much like a double-edged sword, while Bitcoin’s volatility makes it an attractive route for significant gains, it also introduces a high level of risk. The rapid fluctuations in Bitcoin’s value pose a challenge for its utilization as a reliable payment method;

- Security Concerns on Centralized Platforms: Despite their immense contributions towards popularising cryptocurrencies, centralized exchanges are not immune to security breaches and manipulative practices. The fall of high-profile platforms like FTX demonstrates the potential risks and how it can cause damage to its user base’s trust;

- Legislative Ambiguity: The legal landscape concerning Bitcoin is yet to converge globally. While some regions like the European Union have established a clear regulatory framework, others such as the US remain in a state of flux, creating uncertainties for major players in the Bitcoin market. More restrictive regions like China have imposed outright bans, instigating apprehensions among potential adopters;

- Technical Difficulty: While advancements like Layer 2 solutions have greatly enhanced Bitcoin’s scalability, these technical complexities could be daunting for non-tech-oriented users. The ease-of-use barrier poses a significant challenge to the widespread adoption of Bitcoin.

Conclusion

Bitcoin’s remarkable potential in reshaping the global financial system cannot be overstated. However, to truly achieve mass adoption, these underlying challenges must be addressed effectively. The volatility and security concerns linked to Bitcoin, coupled with legal uncertainties and the technical complexity involved, present significant barriers to its widespread acceptance.

As we venture further into a future where Bitcoin continues to grow, the focus must be on developing robust solutions to these challenges. This would pave the way for a more inclusive and secure financial system where Bitcoin holds a central role. By doing so, we can harness the transformative power of Bitcoin to its fullest, enabling it to be a seamless part of our everyday financial transactions.