As the financial world shifts towards decentralization, borrowing and lending protocols in the DeFi (Decentralized Finance) realm have taken center stage. Aave, Compound, and JustLend are among the prominent players in this domain, offering distinct yet overlapping services. This article will attempt to dissect these platforms and provide a comprehensive, insightful comparison, focusing on their individual characteristics and features.

The Evolution of Lending through Decentralization

Decentralized Finance, better known as DeFi, has revolutionized how lending happens in the crypto world. Unlike traditional financial systems, which rely heavily on intermediaries and processes that can be long and cumbersome, DeFi lending happens directly over the blockchain. This substantially eliminates the need for strict background checks and burdensome verification procedures common to conventional banking.

In the decentralized setting, it’s all about smart contracts and decentralized applications (dApps), and blockchain technology. These technological innovations expedite loan procedures, as long as borrowers meet the stipulated collateral criteria. The proof-of-stake mechanism embedded in smart contracts largely streamlines the verification procedure, promoting convenience for both lenders and borrowers.

To protect against the risk of under-collateralization, DeFi lending employs an over-collateralization strategy. As a result, borrowers need to provide collateral higher than the borrowing value, ensuring the loan is sufficiently backed.

One compelling advantage of DeFi platforms is the potential for higher returns for lenders and more competitive interest rates for borrowers, a far cry from what traditional finance markets offer.

Our following guide provides a comprehensive study of DeFi lending technology, its applications, and the benefits it brings.

DeFi Lending Giants: A Review

As per DeFiLlama, the three heavyweights of DeFi lending, as measured by total value locked (TVL) are:

- AAVE: Commands a TVL of $5.79 billion;

- JustLend: Maintains a TVL of $3.75 billion;

- Compound Finance: Holds a TVL of $1.88 billion.

An in-depth analysis of these three protocols can shed light on their individual workings and offerings.

A Deep Dive into AAVE

AAVE, a decentralized lending and borrowing platform, commenced operations on the Ethereum blockchain in January 2020. It has incrementally evolved into a leading player in the DeFi landscape, fostering peer-to-peer transactions within its ecosystem.

Presently, AAVE has carved out nine distinct markets, inclusive of a niche, permissioned DeFi sector for institutional players. Boasting a list of 19 diverse digital assets, AAVE offers a flexible platform for users to lend and borrow without the traditional prerequisites of Know Your Customer (KYC) and Anti-Money Laundering (AML) verifications.

The latest iteration of the protocol, known as AAVE V3, showcases enhanced capital efficiency and expanded cross-chain functionality, backed by superior safety mechanisms. Embedded features of AAVE V3 comprise:

- Supply and Borrow Caps: These set limitations on how much can be borrowed and supplied;

- Isolation Mode: This feature confines an asset purely for borrowing isolated stablecoins using a single asset collateral;

- Siloed Mode: This separates assets that could possibly have compromised oracles.

AAVE dispenses unique offerings like:

- Rate Flexibility: Borrowers can opt for a fixed or variable interest rate;

- Flash Loans: These uncollateralized loans cater to proficient users with a solid grasp of technical intricacies;

- Competitive APYs: Borrow APYs range from a low of 0.09% (LDO) to a high of 17.9% (BAL), averaging about 4.2%.

An Overview of the AAVE Token

The $AAVE token steers the protocol’s governance, facilitating voting on key developmental proposals. Notably, the token can be staked within the AAVE protocol, enabling stakers to bag rewards and also rake in fees. The token’s total supply is strictly capped at 16 million, with a circulating supply of approximately 14.4 million.

Unveiling JustLend: Decentralized Finance on the TRON Network

JustLend manifests as a decentralized finance (DeFi) platform pioneering operations on the TRON blockchain. It provides a conduit for users to earn returns through asset supply, secure digital assets via collateral provision, and participate in TRX staking.

The platform offers an array of 15 distinct assets available for borrowing and lending, thereby enabling a vast spectrum of financial transactions. Unlike other DeFi platforms, JustLend does not feature a proprietary governance token, but it harmonizes with the dynamics of the TRON network.

In every transaction on the TRON network, two vital components, bandwidth and energy, are consumed. Each TRON account is allocated a certain portion of free bandwidth every day. For those in need of additional bandwidth and energy, options exist to burn or stake more TRX.

In April, JustLend propelled its DAO (Decentralized Autonomous Organization) to newer heights with an extensive upgrade resulting in two innovative features:

- Staked TRX: Participants can stake their TRX tokens, earning them sTRX tokens in return, which promise more attracrive yields;

- Energy Rental: This streamlines users’ ability to rent energy or terminate their rental at their discretion. Economically, this method of acquiring energy provides a more viable option compared to traditional means where users procure energy through TRX staking or burning.

JustLend offers a diverse array of Borrow APYs, ranging from a modest 0.95% (USDJ) to a staggering 110.95% (SUNOLD), averaging an attractive 13.31%.

Exploring JST Token

While JustLend doesn’t have a native governance token, the ecosystem does involve the JST token, which acts as a cornerstone to JustLend’s decentralized governance mechanism. The JST token facilitates decision-making and governance: holders can submit proposals and partake in voting to shape the future of the protocol. At present, the market cap of JST is hovering at a remarkable $201 million.

Delving into Compound Finance: A Pioneer in DeFi

Established in 2017, Compound Finance is an autonomous and algorithmic protocol built on the Ethereum network. It enables users to borrow base crypto assets like USDC in exchange for collateral through built-in smart contracts.

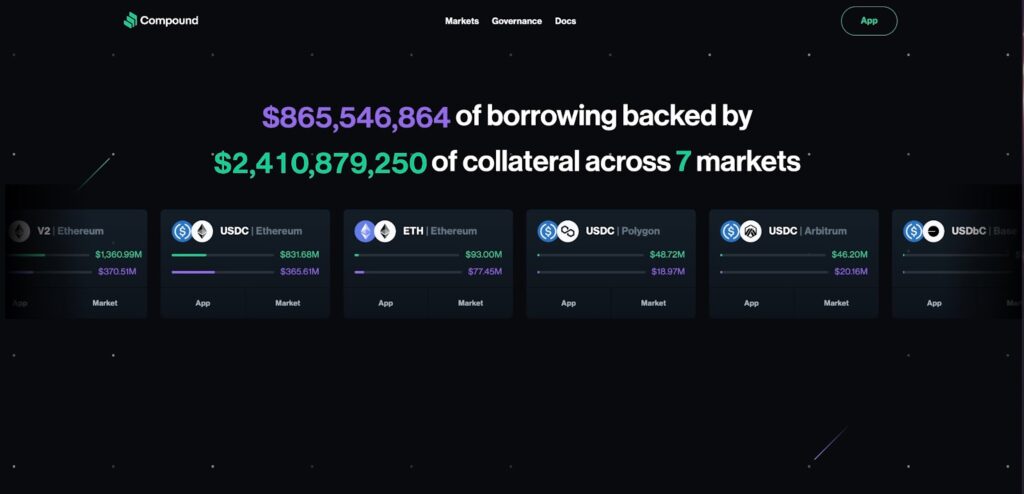

As a decentralized, EVM-compatible platform, it revolutionizes the system by allowing suppliers to accumulate interest on their crypto deposits. Compound Finance presently hosts five distinct markets incorporating 20 diverse assets for seamless lending and borrowing transactions.

With the recent launch of its third version, Compound III, the protocol brought forth numerous enhancements. These upgrades include a comprehensive overhaul of the risk management and liquidation engine, making them more reliable, secure, and user-centric. To mitigate risk, the size of individual collateral assets has been capped. Furthermore, governance, which is easy to navigate, now enjoys full reign over the protocol’s economic policies.

Borrow APYs on Compound Finance are quite varied, spanning from a minimal 0.85% (TUSD) to a significant 25.55% (FEI), with the average standing at 5.42%.

Discovering COMP Token

Initially, Compound Finance had a highly centralized structure. However, the introduction of the $COMP token has pushed the platform towards a more decentralized paradigm. As an ERC-20 token, $COMP is vital for governance. Holders can contribute to the protocol’s evolution by participating in debates, proposing changes, and voting on protocol modifications, or they can delegate these responsibilities to a trusted entity. $COMP’s total supply is strictly pegged at 10 million, with roughly 6.8 million tokens presently in circulation.

Crypto Fundamental Analysis: Bridging the Gap

In the dynamic world of cryptocurrency, fundamental analysis plays a pivotal role in assessing the value and potential of digital assets. It involves examining factors such as technology, team, use cases, and market demand to determine the intrinsic value of a cryptocurrency. Just as fundamental analysis is critical for traditional financial assets, it holds equal importance in the DeFi space.

By incorporating crypto fundamental analysis into our comparison of Aave, JustLend, and Compound Finance, we can bridge the gap between the technical intricacies of these platforms and their real-world impact. This holistic approach provides investors and users with a comprehensive understanding of the potential risks and rewards associated with these DeFi lending giants.

Conclusion

In summary, the growth of DeFi lending protocols – Aave, JustLend, and Compound Finance – has been instrumental in shaping the future of borrowing and lending within the cryptocurrency world. They offer novel, interactive avenues for users to optimize their financial activities, facilitating a higher degree of transparency and efficiency as compared to traditional banking systems. As these platforms continue to innovate and evolve, utilizing unique features and robust security measures, they undeniably serve as key pillars in the expanding universe of decentralized finance. These platforms are not only transforming the way we perceive traditional banking but also unlocking unprecedented opportunities for individuals and institutions in the digital age.